People with credit card debt usually have one major concern: How can I get out of debt? There are a lot of things a consumer can do to help better their situation like earning additional income, reducing their spending, creating a budget, seeking credit counseling, or even a debt management program. All of these are great techniques for better financial management and debt repayment, but there are also two very simple methods to pay off credit card debt.

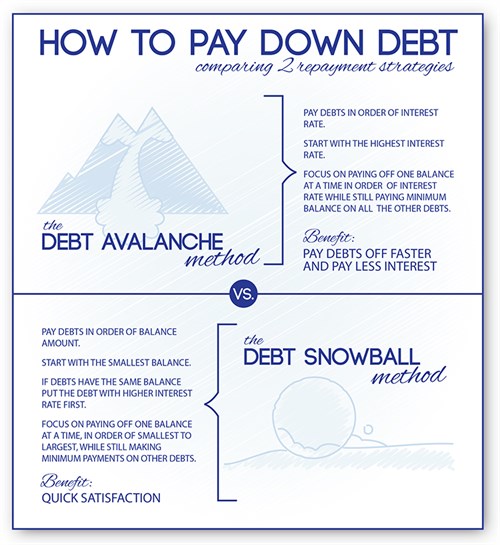

The Debt Avalanche and The Debt Snowball

These two debt repayment strategies offer recipes for success when it comes to paying off debt. Both methods are based on the idea that you should focus more effort and money towards one account at a time. The Debt Snowball tackles the account with the smallest balance first, while the Debt Avalanche focuses on the account with the highest interest rate. See the image below for an explanation of both.

Your choice of debt repayment strategy can be based on your personality and your goals. If you like to see fast results that will motivate you, then you may choose the debt snowball. If you like to tackle your biggest issues and want to save as much money as possible, then maybe the debt avalanche is right for you. Regardless of your repayment method, you could also benefit from speaking to a certified credit counselor to analyze your budget.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.