The older you get, the more you hear about the elusive compound interest. Everyone knows it’s a good thing, but how does it really work? Our credit counseling advice is to learn about it. Let’s go through some examples to find out the answer.

Compound Interest Explained

Simply put, compound interest is interest on the interest you’ve already built. As you earn interest, it gets added to the pot. But there is always interest ahead. So it keeps going and going and going. This process can go a long way in turning your investment into retirement savings.

Short-term Saving & Compound Interest

Many people assume that compound interest only applies for retirement savings and long-term goals. However, if you have a short-term savings goal, compound interest can still help. Let’s say you save $1,000 per year in a savings account that pays you 3% interest compounded annually. The example below shows you how much you will have after 5 years. Therefore, you will earn $468.41 in interest! The longer you keep saving the more interest you will earn.

5 Year Savings Example

Year 1: $1,000 + $30.00 interest= $1,030

Year 2: $1,030 + $1,000 deposit + $60.90 interest= $2,090.90

Year 3: $2,090.90 +$1,000 deposit + $92.73 interest= $3,183.63

Year 4: $3,183.63 + $1,000 deposit + $125.51 interest= $4,309.14

Year 5: $4,309.14 +$1,000 deposit + $159.27 interest= $5,468.41

Long-term Investing & Compound Interest

Now, the big money comes when you are able to invest in the stock market. The interest rates are historically much higher than just putting money into savings accounts.

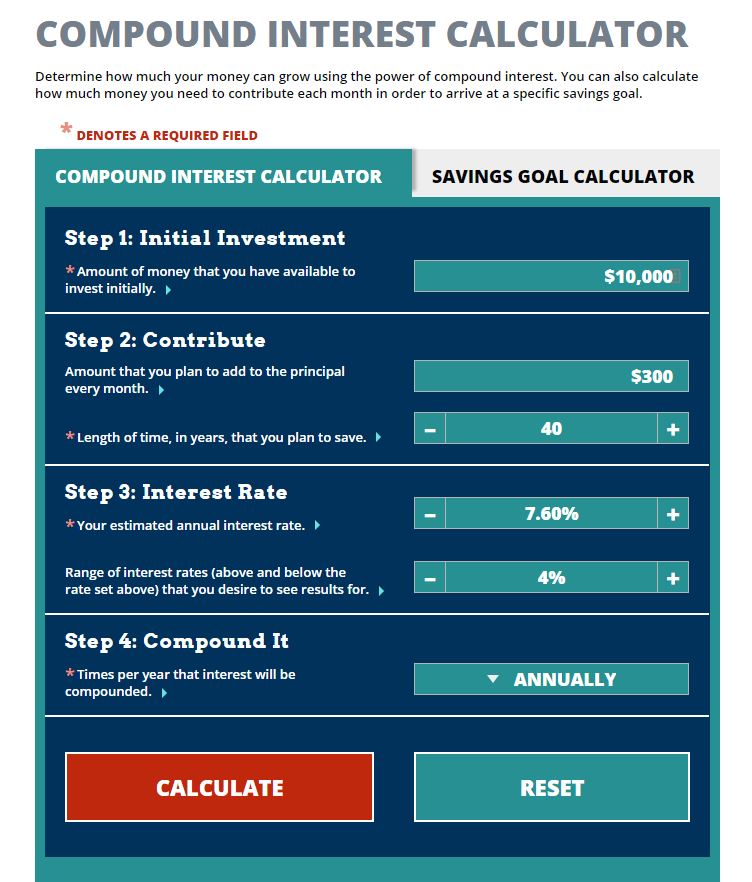

In this next example, I used this Investment Calculator from the government. I plugged in an example using an initial investment of $10,000, with a monthly contribution of $300. Check out the rest of the details below:

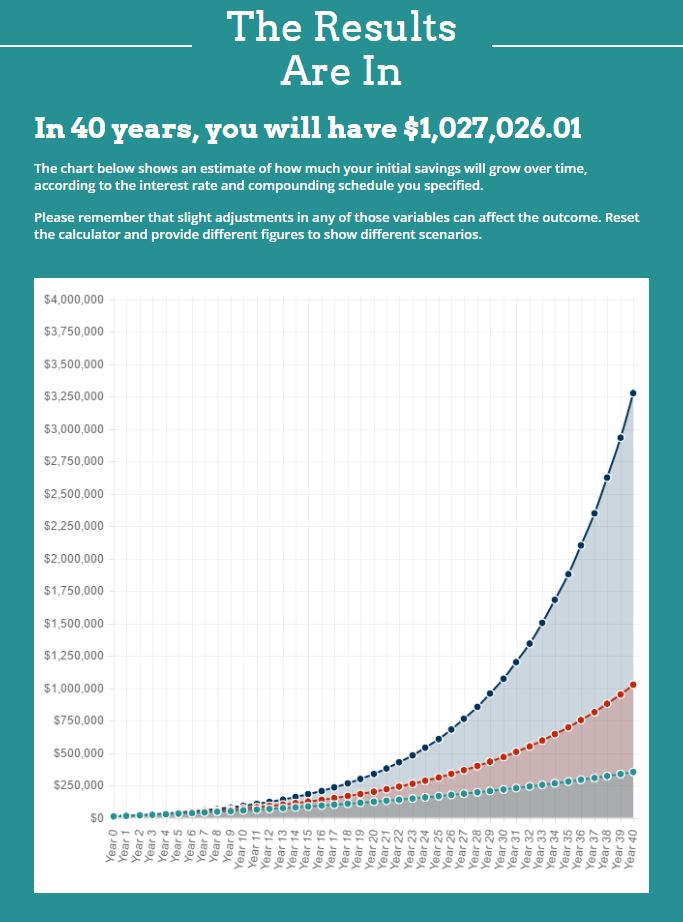

Finally, here are the results of the calculation above:

A little nest egg was able to grow into a very substantial amount in this example.

As your salary increases and debts decrease, you will definitely want to increase your investment percentage. Between investing in the stock market, CD’s and other ways to save for retirement, you should be able to allocate 10-15% of your income to retirement savings.

Your monthly contribution to your investments might be a combination of your own percentage, plus the matching percentage from your employer. At the very least, you should start investing the maximum amount that your employer will match. So if they will match up to 3%, your total would be 6%: 3% from you and a matching 3% from your employer.

Overall, compound interest can be a great asset to the growth of your investment. While the market is unpredictable, the basic principle of compound interest remains the same.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.