Relationships and money can become complicated and explosive very quickly. That’s why our credit counseling advice is to start on the right foot or correct missteps as quickly as possible. Use these budget tips for couples to achieve more with your finances and hopefully avoid some relationship chaos.

Budget Tips for Couples

Money can be a very personal topic. Everyone grows up learning different habits and principles; they also bring different successes and failures to the table. There will always be a past, present, and future to your finances. So how can a couple better manage and discuss their finances together?

Manage Your Money Together

Simply put: manage your money together. Budget, set goals and priorities, and think of your money as “one.” You and your money are both moving forward together. Rather than trying to manage your own money generally in the same direction, become a unified front on all things.

Do you have to combine your bank accounts? Not necessarily. In this writer’s opinion, it does seem to help establish a more positive mindset for the “one” finances concept. However, many happy couples keep their own accounts. Another option is to allow each person a bank account for spending and a joint account for all bills. As we continue talking about budget tips for couples, this first principle should remain in your mind.

Communicate Openly & Often About Your Finances

Just like any other part of a relationship, open communication is key. If you are feeling unheard, overwhelmed by expectations or that something needs to change, it’s important to speak up. Both perspectives are key to managing and growing your finances together. Here are a few things to keep in mind:

- Have regular budgeting meetings so there is always a time to review and share.

- Speak calmly with your partner. Don’t bring up past failures.

- Remember to be encouraging and celebrate the victories- like debt reduction.

- Consider all the options, including a compromise. Take time to think things through well.

- Be prepared to change plans if something unexpected arises.

Budget Tips for Couples Getting Married

Sometimes it can be difficult admitting your shortcomings to your partner. However, it’s probably far worse to keep secrets and lies! Couples getting married can avoid a lot of financial stress by planning a reasonable and affordable wedding for their budget. They can also take the time to share everything there is to know about their individual finances before getting officially married. This will probably make the financial struggles and failures feel less like secrets than if you are already married and sharing the information for the first time. Plus, you can decide on financial goals and strategies even before you walk down the aisle- like how to pay off credit card debt fast.

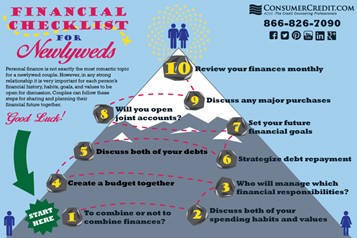

Here is a Checklist for Newlyweds infographic to review:

Finally, remember to be patient, flexible and determined as you manage your money together. Supporting one another is the best way forward. Help someone reduce their retail therapy; don’t go overboard counting every single dollar spent over budget. Your budget can become the backbone and road map to your financial well being, so use it!

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.