As we share more and more online, our identities and information become increasingly vulnerable to identity thieves. There are steps parents and guardians can take to help prevent such attacks against their families. Take steps now to protect your child’s personal information to prevent legal and financial troubles (such as debt) later.

Protecting Your Child’s Personal Information

There are several ways to protect your child’s identity from attacks. Here are a few suggestions to get you started.

- Keep all paper and electronic records with your child’s personal information in a safe location.

- Don’t share your child’s Social Security number unless you know and trust the other party. Ask why it’s necessary and how it will be protected. Ask if you can use a different identifier, or use only the last four digits of your child’s Social Security number.

- Shred all documents that show your child’s personal information.

- If you lose a wallet, purse or paperwork that has your child’s Social Security information, be sure to report them missing.

Paper trails exist on paper and electronically. Protecting your child from identity theft can help prevent future financial and other serious ramifications, such as consumer debt.

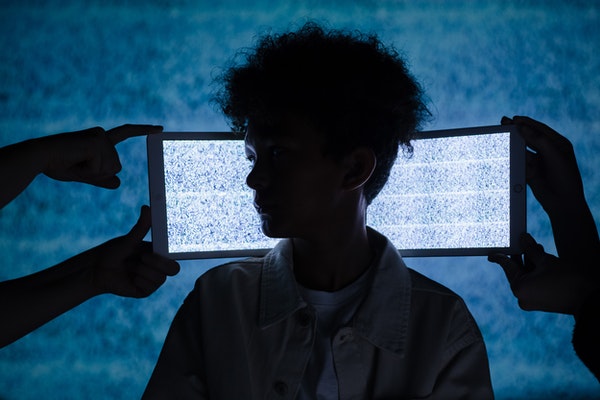

What About Your Child’s Personal Information on Social Media?

I have to attempt the joy I feel seeing all the cute photos of babies and kids in my newsfeed. However, sharing any information about your kids is a risk in this digital world. While you may have a lot of privacy settings selected, you can’t always stop the spread of information.

For example, if you post your child’s full name and date of birth on your account, an identity thief can use public records to look up your address. Now they have three very important pieces of information to use against you to cause unknown amounts of credit problems.

Additionally, protecting your child’s personal information never stops. Think about them interviewing for jobs and for college admission down the road. Anything you publish on the Internet never goes away. All those embarrassing photos and videos can haunt them. The embarrassment grows as they get older with all the silly moments with their friends. They need to understand how important it is to manage their profiles in a respectful way. In fact, there are companies actually saving information. It’s creepy! We need to be aware and evaluate how much risk to take.

It’s good to be cautious. However, it’s up to each family to decide what they think is best for them and their kids.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.