If you’re wondering how to pay down debt you’re not alone. 46.7% of all households nationwide are carrying credit card balances and trying to navigate debt management. If you are one of the 46.7% you are most likely looking for credit relief. You’ll be happy to know that you have choices for getting out of debt depending on what works best for you. We’re looking at Snowball vs Avalanche Method today.

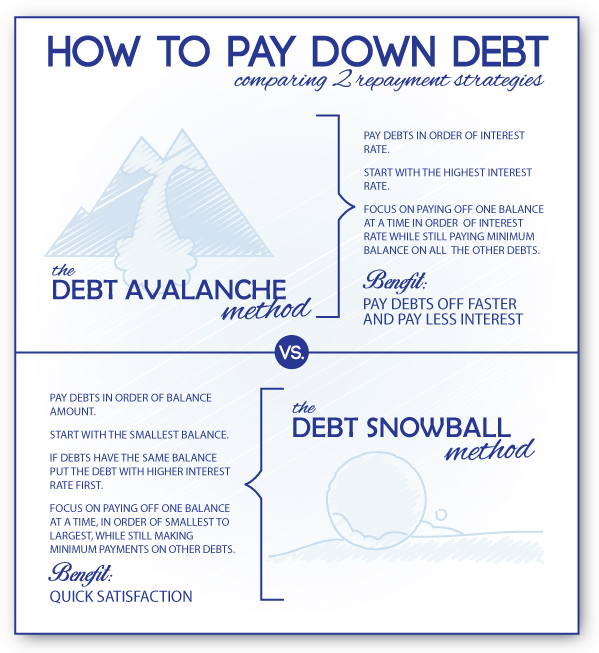

The following plans are all about focusing on one thing at a time. For both of the following strategies, you’ll pay as much as you can towards one of your debts, and make the minimum payments to the others. See below to decide which debt to focus on first.

Choice #1: Debt Snowball Plan

List all your debts in order of balance amount, with the smallest balance first. If, and only if two debts have a similar balance, look at the interest rates. List the debt with the higher interest rate first. Now, while paying the minimum balance on everything else, focus on paying off one balance at a time in order. The benefit of this plan is that attacking the little debts first gives you quick satisfaction. Chances are you are more likely to stick with it if you are seeing a reward for your hard work.

Choice #2: Debt Avalanche Plan

List all your debts in order of interest rate, with the highest interest rate first. While paying the minimum balance on everything else, focus on paying off one balance at a time, starting with the balance that has the highest interest rate. Once the debt at the top of the list is paid off, move on to the next debt on the list. Mathematically, this method will allow you to pay your debts off faster and pay less interest. But, this method can be more difficult to stick with because you may not have the “early success” you will have if you use the Debt Snowball Plan.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.